Are daily financial record-keeping tasks for your business overwhelming your schedule? Don’t worry, Apki Return is here to take this burden off your shoulders. We’ll manage your business’s financial records regularly, giving you more time to focus on growing your business.

Accounting is the systematic recording, reporting, and analysis of financial transactions of a business. Its primary purpose is to provide financial information about a company to various stakeholders, including managers, investors, creditors and regulatory agencies. Accounting is a vital practice in the business world, serving as the language of finance and a crucial tool for decision-making.

Running a business is exciting, but numbers can feel like a foreign language. Fear not! This quick guide gets you up and running with accounting and bookkeeping, the essential tools to understand your financial story.

Imagine your business as a movie. Accounting is like the director, capturing every financial scene – sales, expenses, profits – and turning them into informative reports. These reports let you see:

Focuses on reporting company financial information to external parties, such as investors and creditors.

Deals with internal financial analysis for business decision-making.

Centres on calculating and analysing costs associated with producing goods or services.

Involves preparation and filing of tax returns and understanding tax laws.

The use of accounting skills to investigate financial discrepancies and fraud.

These are the meticulous actors, diligently recording every financial transaction, like purchases, payments and salaries. Think of them as double-checking every scene, ensuring the numbers perfectly tell your story.

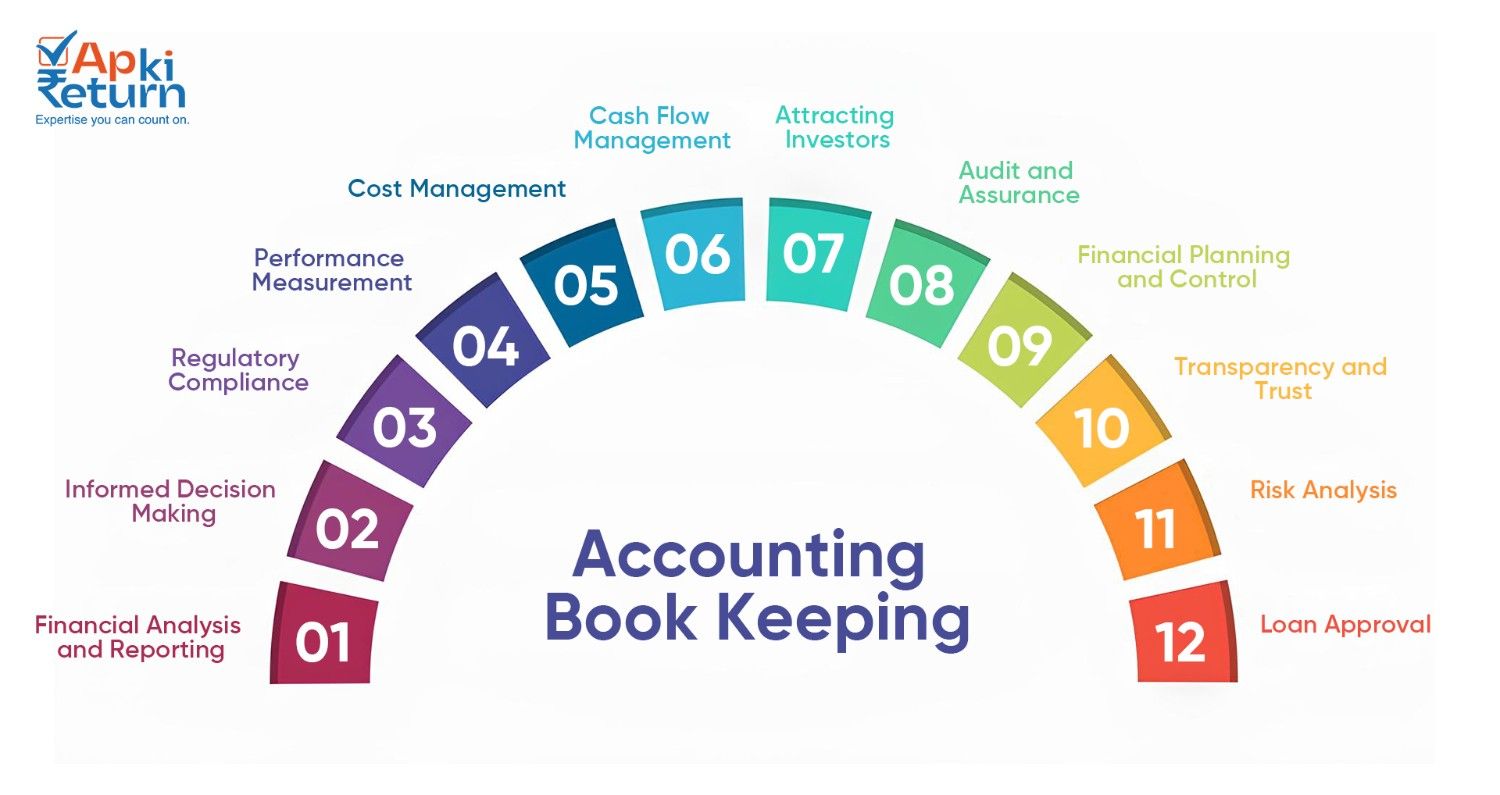

Accounting provides a clear picture of the business’s financial health by tracking income, expenses, assets and liabilities. This helps in preparing essential financial statements like the balance sheet, income statement and cash flow statement.

With accurate accounting, management can make informed decisions. It aids in budgeting, forecasting and strategic planning, helping businesses to allocate resources efficiently and plan for the future.

Proper accounting ensures compliance with various regulatory requirements. Accurate financial records are crucial for tax purposes and complying with laws and regulations.

Accounting helps in assessing the performance of a business over a period. By comparing current data with past data, businesses can gauge their financial progress and growth.

Through accounting, businesses can track and manage their costs effectively. Cost accounting helps in understanding the cost structure of products or services, leading to better pricing strategies and profit margins.

Effective accounting helps in managing the cash flow, ensuring that the business has enough cash to meet its obligations. It’s crucial for maintaining liquidity and solvency.

Well-maintained financial records through accounting can attract investors. Clear financial statements are essential for investors to assess the financial health and potential of a business.

Accounting facilitates audit processes. Auditors use financial records to assess the accuracy and integrity of a company’s financial statements. It also assures the we can analysis our deficiencies prior the Audit.

It helps in setting financial targets and budgets, and controlling expenditure to ensure that financial goals are met.

Good accounting practices enhance transparency, building trust among stakeholders, including investors, customers and employees.

Accounting assists in risk assessment and management. Financial records can reveal areas of financial risk and enable proactive measures.

For businesses seeking loans, well-kept accounting records increase the likelihood of loan approval as they demonstrate the company’s financial stability.

Accounting is the systematic process of recording, analysing, and interpreting financial information. It’s essential for tracking income and expenditure and making strategic business decisions.

The major types include financial accounting, management accounting, cost accounting, tax accounting and forensic accounting, each serving different purposes and stakeholders.

Accounting provides critical information for decision-making, helps in financial planning, ensures statutory compliance and is fundamental for tracking the financial health of a business.

Bookkeeping is the process of recording financial transactions, which is a subset of accounting. Accounting includes interpreting and analysing financial data, preparing financial statements and advising on financial decisions.

GAAP are standardized guidelines and rules for financial accounting and reporting. They ensure consistency and comparability of financial statements across different organizations.

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

An income statement, also known as a profit and loss statement, shows a company’s revenues, expenses and profits or losses over a specific period.

Technology, especially software like QuickBooks or cloud-based accounting platforms, has automated many traditional accounting tasks, improved accuracy and provided real-time financial insights.

Key skills include a strong understanding of accounting principles, proficiency in accounting software, analytical skills, attention to detail and ethical standards.

We proudly announce our new website packed with updated data, resources, and valuable information