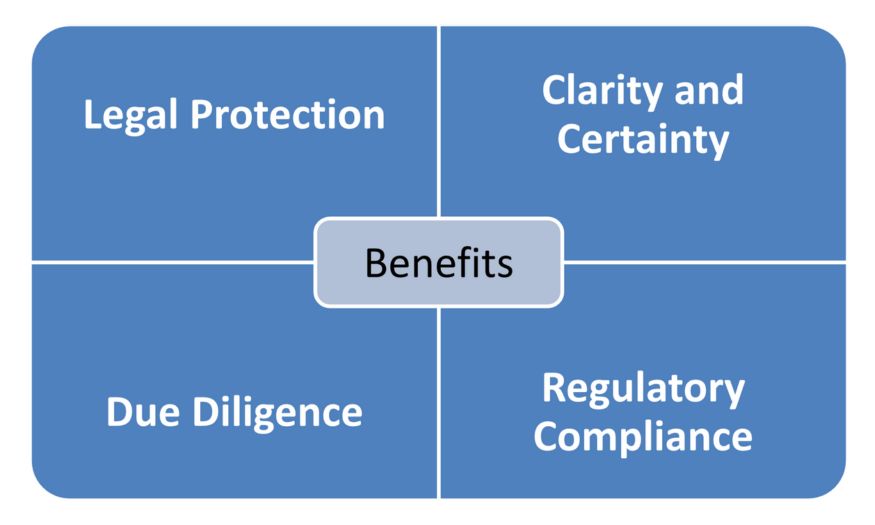

A share purchase agreement is a contract between a company (seller) and an investor (Buyer) who is buying shares. It outlines the terms and conditions under which the shares of a company are sold and bought between a buyer and a seller. A Share Purchase Agreement is a critical document in the process of buying and selling shares in a company, offering clarity, legal protection and ensuring a smooth transfer of ownership under agreed terms.

Identification of the seller and buyer of the shares.

Detailed description of the shares being sold, including the class of shares, number of shares and any associated rights.

The price at which the shares are being sold and the method of payment.

Statements by both parties about the company and its shares, assuring certain facts such as the seller’s ownership of shares, the company’s financial status, compliance with laws and absence of liabilities or ongoing legal issues.

Conditions that must be fulfilled before the completion of the share purchase.

Agreements by the parties to do or refrain from doing certain things before and after the share sale, like conducting business in the ordinary course.

Steps and documents required to complete the share transfer, including share transfer forms, board resolutions and updating the company’s share register.

Provisions for indemnification of the buyer by the seller against losses arising from breaches of the agreement or misrepresentations.

Agreements to keep the transaction and any sensitive information confidential.

Conditions under which the agreement can be terminated before the shares are transferred.

Mechanisms for resolving disputes that arise out of the agreement, including jurisdiction and choice of law.

Other standard clauses such as entire agreements, amendments, notices and waivers.

An SPA is a formal contract that outlines the terms and conditions for the sale and purchase of shares in a company.

It is used when shares of a company are being sold from one party to another – either from shareholder to shareholder or from shareholder to an outside buyer.

Typical components include details of the parties, description of the shares, purchase price, payment terms, representations and warranties, conditions precedent, confidentiality obligations and dispute resolution mechanisms.

Yes, an SPA is a legally binding agreement once it is signed by both parties.

An SPA is specifically for the sale and purchase of shares, whereas a Shareholders’ Agreement outlines the ongoing relationship, rights and obligations of the shareholders of a company.

Given its complexity and legal significance, it’s advisable to engage a lawyer to draft or review an SPA.

These are statements of fact or promises made by the seller to reassure the buyer about various aspects of the company and its shares.

Due diligence is the process of investigation and evaluation, conducted by the buyer, into the affairs of the company whose shares are being purchased.

Yes, the terms of an SPA are often subject to negotiation between the buyer and the seller.

A breach can lead to legal action. The agreement itself usually specifies the remedies available, including indemnities or damages.

We proudly announce our new website packed with updated data, resources, and valuable information