A Proprietorship Firm, also known as a sole proprietorship, is one of the simplest and most common forms of business ownership. It is an unincorporated business owned and run by one individual, where there is no legal distinction between the owner and the business entity. This type of business structure is popular among individual self-contractors, consultants, and small business owners due to its simplicity, ease of setup, and nominal cost.

The most defining characteristic of a proprietorship is that it is owned by a single individual. This means all profits, responsibilities, and liabilities are solely the burden and benefit of the owner. Setting up a proprietorship is generally straightforward with minimal legal formalities. Similarly, winding down the business is simpler compared to other business forms. Unlike corporations, a proprietorship is not a separate legal entity from its owner. This means that the business cannot enter into legal contracts, own property, or sue or be sued independently of the owner.

A proprietorship firm is an ideal business structure for individuals who wish to have total control over their business with minimal regulatory hurdles. However, the risks associated with unlimited personal liability and challenges in capital acquisition should be carefully considered. This business form suits those who are starting small and are comfortable with intertwining their personal and business finances and risks.

Get the business name availability status directly on WhatsApp

The first step is to select a unique name for your business. It’s important to ensure that the name does not infringe upon existing trademarks and is in compliance with local regulations.

If you don’t already have one, apply for a Personal Account Number (PAN) card in your name. Since the proprietor and the business are legally the same entity, your personal PAN will be used for business transactions.

Open a current account in the name of the business. Banks will require proof of the existence of your business, such as registration certificates, to open the account.

If your business involves a physical shop or a commercial establishment, it’s necessary to register under the Shop and Establishment Act. This act regulates conditions of work and lists rights of employees in the unorganized sector. The procedure and requirements for this registration vary by state.

If your turnover exceeds the GST exemption limit (currently set at Rs. 20 lakhs for services and Rs. 40 lakhs for goods, subject to change as per government norms), or if you are involved in inter-state supply of goods and services, you should register for GST. This involves submitting various documents and completing the registration process on the GST portal.

Depending on the nature of your business, you may need specific licenses or registrations:

Check with local authorities (municipal corporation, panchayat, etc.) to see if any additional registrations or compliances are required based on your business location and type.

While a proprietorship doesn’t necessarily require formal financial audits, maintaining clear financial records is crucial for tax purposes and for managing the business effectively.

As a business owner, you’re responsible for complying with tax regulations, including filing income tax returns, GST returns (if registered), and other relevant tax compliances.

It might be beneficial to hire a professional to help with setting up and maintaining your business, especially for handling tax filings and ensuring compliance with various legal requirements.

PAN Card of proposed Directors

Both PAN and Aadhaar Card of all Indian Shareholders and Directors.

Business Address Proof

Either of the latest Utility Bill (Electricity, Telephone, Gas, Water) or Property Tax Bill of the registered office address. Rent agreement and NOC from the owner in case of rented property.

Aadhaar Card/ Passport of proposed Directors

Either Voter ID, Passport, or Driving License of the Shareholders and Directors.

Mail ID and Mobile number

Mail ID and Mobile number of proposed Director along with Draft Articles of Association and Draft Memorandum of Association.

Latest passport size photograph of proposed Directors

Latest passport size photographs of all the Shareholders and Directors.

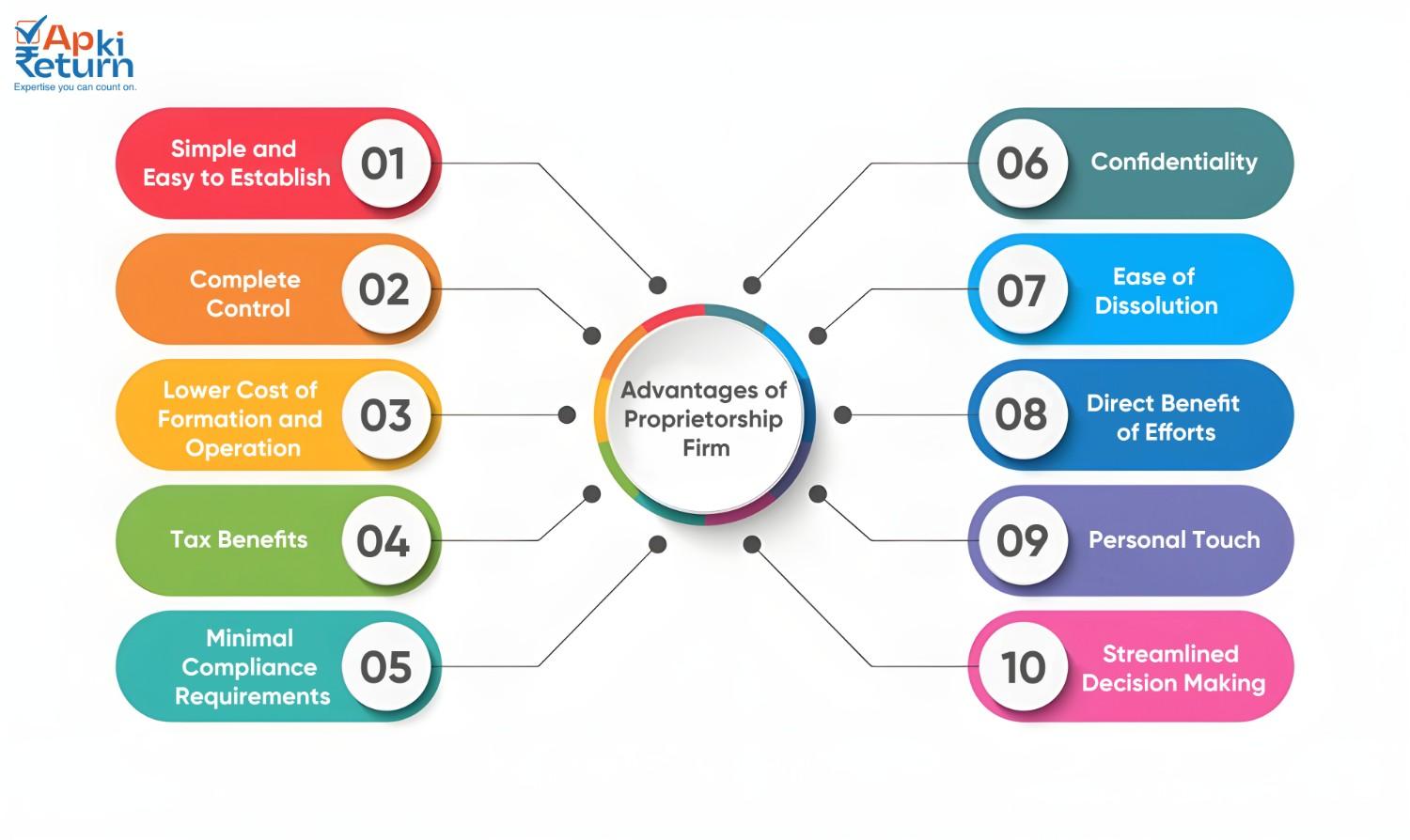

One of the most significant advantages of a proprietorship firm is its ease of setup. With minimal legal formalities and a straightforward registration process, it’s one of the simplest business forms to establish. This simplicity extends to the ongoing management and compliance requirements, which are generally less burdensome than those for corporations or partnerships.

As the sole owner, the proprietor has total control over all business decisions. This level of autonomy allows for quick decision-making and flexibility, enabling the business to adapt rapidly to changing market conditions or customer needs.

Proprietorships typically incur lower startup costs compared to other business structures. The ongoing operational costs are also reduced since there are fewer regulatory requirements and lower compliance costs.

In a proprietorship, business income is treated as the owner’s personal income. Therefore, it is taxed only once, avoiding the potential for double taxation seen in some other business entities like corporations. Additionally, proprietors can often take advantage of certain tax deductions that reduce taxable income.

Proprietorships generally face fewer government rules and regulations. The reporting requirements, bookkeeping, and audits are less stringent compared to corporations, making it easier to comply with legal requirements.

Since the proprietor is the sole decision-maker, strategic business decisions and financial performance details can be kept private, which might not be the case in a corporation where shareholders have a right to this information.

Just as it is easy to set up, a proprietorship can be easily dissolved. The process is straightforward and does not involve complex legal procedures, which is beneficial in case the owner decides to cease business operations.

The proprietor directly reaps the benefits of the business’s success. Unlike in a corporation or partnership, where profits are shared among shareholders or partners, the proprietor enjoys the full fruits of their labor.

Proprietorships often benefit from a personal touch in customer service and business relationships. The direct involvement of the owner can lead to stronger customer loyalty and personalized service.

Without the need to consult with partners or a board of Proprietor, decision-making in a proprietorship is quick and straightforward, allowing for greater efficiency and agility in business operations.

If your business is registered under GST:

If applicable in your state, ensure compliance with Professional Tax requirements. This involves periodic payments and filing of returns.

If you have registered under the Shop and Establishment Act, ensure compliance with its provisions, which may include maintaining certain records, adhering to working hours, holidays, leave policy, etc.

Ensure timely renewal of all business licenses and registrations, such as FSSAI for food businesses, Import Export Code, etc.

Maintain proper books of accounts. While there are no statutory audit requirements for proprietorships, having well-maintained financial records is vital for tax purposes and effective business management.

If you employ workers, comply with relevant labour laws, including minimum wages, provident fund, employee state insurance, gratuity, etc.

Unlike companies, proprietorships do not have to file annual returns with the Ministry of Corporate Affairs (MCA). However, maintaining annual financial statements (balance sheet, profit and loss account) is advisable for internal management and tax purposes.

Depending on the sector of your business, there might be additional compliances. For example, environmental clearances for manufacturing units, safety regulations for businesses dealing with hazardous materials, etc.

Consider obtaining relevant business insurance policies to mitigate risks associated with business operations.

We believe in complete hand holding of our client, we will assign a personal manager to help you complete the entire process of Proprietorship Firm registration. Our team will guide you through the entire process and will get all the requisite registrations done for your proprietorship firm in a reasonable time subject to providing of necessary documents/information by the client.

Arrange the KYC documents of the Proprietor of the entity.

Arrange the Identity & Address Proof of the Proprietor of the entity.

Get the Udyog Aadhar/MSME registration of the Proprietorship firm, which is a quite simple process and can be done online.

Get the BRN registration of the Proprietorship firm, which is a quite simple process and can be done online.

Once the firm is registered, you should open a current account in the name of the business. This is important for managing your business finances separately from your personal finances.

A Proprietorship Firm is a business entity that is owned and operated by a single individual. It is the simplest form of business structure, where the owner has complete control over the business and there is no legal distinction between the owner and the business.

In India, there is no formal registration process for a sole proprietorship. However, the proprietor may need to obtain licenses specific to their line of business, such as GST registration, Shop and Establishment Act license, etc.

The key advantages include ease of setup and operation, complete control by the owner, minimal compliance requirements and tax benefits as the income is taxed as the owner’s personal income.

The main disadvantages are unlimited personal liability of the owner, difficulty in raising capital and lack of continuity of the business in the event of the owner’s death or incapacitation.

The income of the proprietorship is taxed as the personal income of the owner. The proprietor pays income tax as per the individual tax slabs and is subject to file an income tax return annually.

While not legally mandatory, it is highly recommended to maintain a separate bank account for business transactions to ensure financial clarity and for ease of accounting.

Transferring a proprietorship can be complex as it is intrinsically tied to the individual owner. The assets and liabilities can be transferred to another person, but the business in its entirety cannot be transferred as a going concern.

Typically, banks require identity and address proof of the proprietor (like Aadhaar and PAN), along with evidence of the existence of the business (like GST registration, Shop and Establishment license).

Proprietorship firms primarily rely on personal savings, loans from friends and family or bank loans. They cannot raise funds by issuing shares or equity.

No, a proprietorship does not have a separate legal identity from its owner. The owner is personally liable for all debts and obligations of the business.

We proudly announce our new website packed with updated data, resources, and valuable information