Provident Fund (PF):- The Provident Fund (PF) is a government-mandated retirement savings scheme used in India. It’s a major tool for building a retirement corpus for employees in the organized sector. Both the employee and employer contribute a fixed percentage of the employee’s basic salary and dearness allowance to the PF account each month.

In India, the current rate is generally 12% of the basic salary plus dearness allowance, contributed by both the employee and employer. In India, registration for the Provident Fund (PF) is governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

Any establishment that employs 20 or more persons is mandatorily required to register for the Employees’ Provident Fund. This includes factories, businesses and other establishments as defined in the Act.

Establishments with fewer than 20 employees can voluntarily opt for PF registration. Once an establishment opts for PF registration, it remains covered under the Act, even if the employee count falls below the specified number.

Generally, any salaried employee with a monthly income of less than Rs. 15,000 is mandatorily required to be enrolled in the PF scheme by their employer.

Those earning above Rs. 15,000 per month can choose to opt-in or opt-out of the scheme, but if they opt-in at any point, they cannot opt out later.

PF acts as a significant savings tool for retirement, ensuring financial security for employees in their post-working years.

The amount accumulated in PF accounts earns interest, which is compounded annually, leading to a substantial corpus over the long term.

Contributions to PF are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the interest earned and the maturity amount are generally exempt from tax, making it a tax-efficient investment.

PF can be withdrawn partially or fully under certain conditions like marriage, education, medical emergency, home loan repayment, and unemployment, providing financial support during emergencies.

Under the Employees’ Deposit Linked Insurance Scheme (EDLIS), PF members get a life insurance cover, providing additional financial security.

A portion of the employer’s contribution goes towards the Employees’ Pension Scheme (EPS), which provides a pension after retirement.

Offering PF enhances the company’s benefits package, contributing to higher employee satisfaction and retention. It’s seen as an employer’s commitment to the long-term welfare of their employees.

Registering for PF helps employers comply with legal requirements, avoiding penalties and legal issues.

Compliance with PF regulations enhances the company’s image and reputation as a law-abiding and employee-friendly organization.

Employers also get tax benefits for their contribution to the employees’ PF accounts. Contributions are tax-deductible as a business expense.

By contributing to PF, employers can offset some of their responsibilities towards employees’ post-retirement life, reducing long-term liabilities.

PF provides a structured way for employers to contribute to employees’ retirement plans, which is easier to manage compared to private pension plans.

If the withdrawal before 5 years is due to the employee’s ill health, discontinuation of the employer’s business, or other reasons beyond the employee’s control (like layoffs), the withdrawal is not taxable.

If you transfer your PF amount from one employer to another, it is not considered a withdrawal, and hence, it does not attract any tax.

TDS (Tax Deducted at Source) is applicable at the rate of 10% if the withdrawal amount exceeds Rs. 50,000, and you have rendered less than 5 years of service.

If PAN is submitted, and Form 15G/15H (as applicable) is submitted for low/no tax liability, TDS may not be deducted.

The PF contributions by both employer and employee need to be deposited within 15 days from the end of each month. For example, the PF contribution for the month of January must be deposited by the 15th of February.

Along with the PF deposit, employers are also required to file monthly returns. This is generally due by the 15th of the following month, coinciding with the deadline for the PF deposit. The monthly return includes details of the employees, their wages and the amount of PF deducted and paid.

In certain cases, annual returns may also be required. The due date for filing annual returns is typically the 30th of April of the following year.

Employee State Insurance (ESI) is a self-financing social security and health insurance scheme for Indian workers. It is managed by the Employee State Insurance Corporation (ESIC), an autonomous corporation under the Ministry of Labour and Employment, Government of India. This scheme is designed to provide protection to employees against financial distress arising out of sickness, disability, and death due to employment injury and to provide medical care to insured persons and their families.

The ESI scheme is applicable to all factories and specified establishments (like shops, hotels, restaurants, cinemas, road-motor transport undertakings, newspaper establishments, etc.) employing a certain number of employees. The specific number can vary based on state legislation but is generally 10 or more employees.

ESI registration is also required if the establishment employs individuals whose wages do not exceed the wage limit set by the ESI Act. As of the latest update, this wage limit is Rs. 21,000 per month (Rs. 25,000 for persons with disabilities).

The ESI scheme is implemented in a phased manner and is currently operational in most parts of India. Employers must register if their establishment is located in an area where the ESI Act is applicable.

Registration under the ESI Act is mandatory for entities falling under the above criteria. Non-compliance can result in penalties.

In some cases, establishments employing fewer than the required number of employees can opt for voluntary coverage under the ESI scheme.

Comprehensive medical care is provided to employees and their families, including full medical coverage at ESI hospitals and dispensaries.

Financial assistance is provided in the form of sickness benefits when the insured employee is unable to work due to illness.

Pregnant women are entitled to maternity benefits for a certain period, ensuring financial support during maternity leave.

In case of a disability caused by an employment injury or occupational disease, the ESI scheme provides financial assistance to the employee.

In the unfortunate event of an employee’s death due to an employment injury, dependents of the employee receive financial assistance.

The Rajiv Gandhi Shramik Kalyan Yojana under the ESI scheme provides unemployment allowance to workers who have lost their job due to retrenchment or closure of the factory.

Employees disabled due to an employment injury are entitled to a rehabilitation allowance.

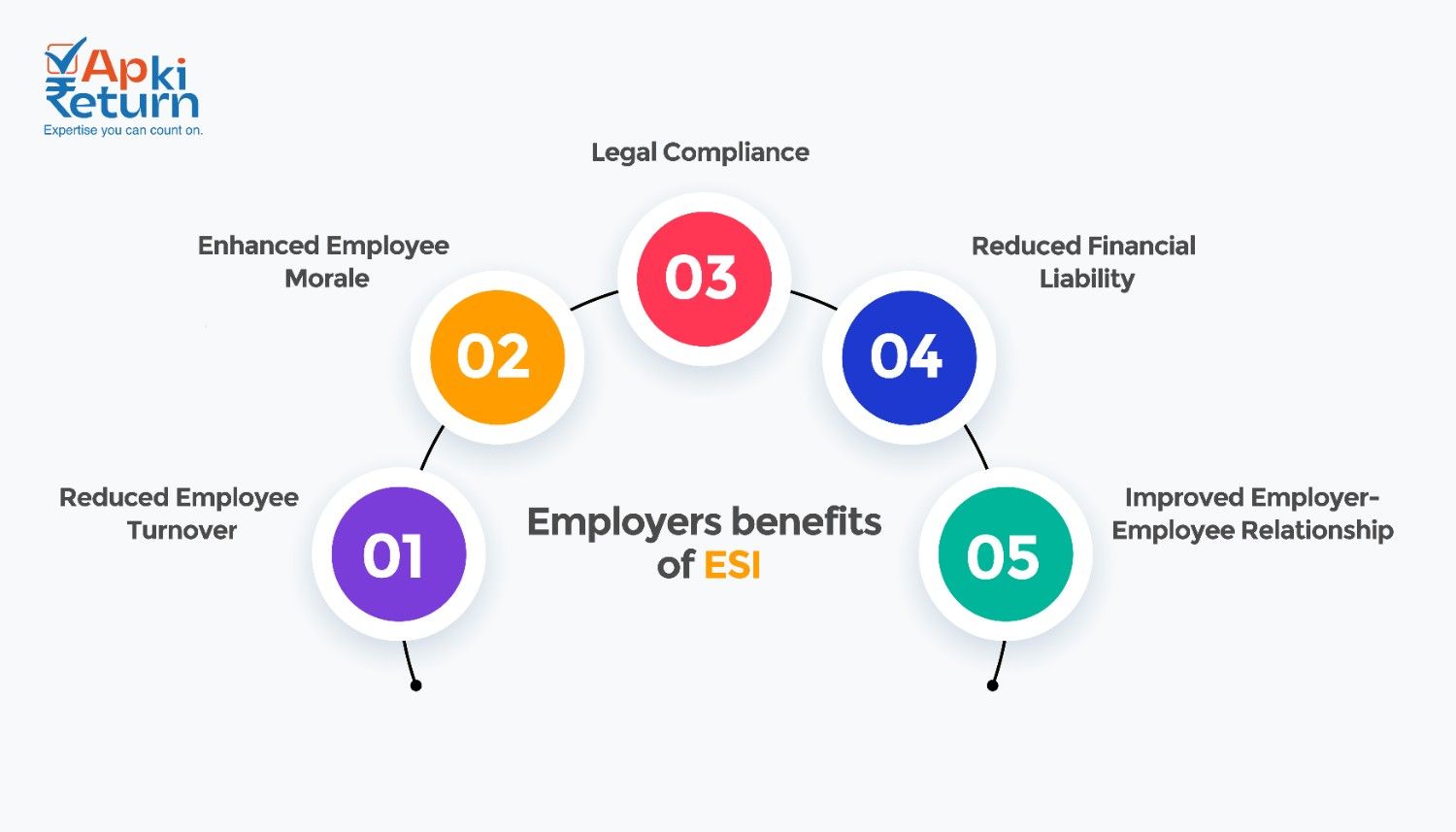

By providing comprehensive social security benefits, the ESI scheme increases job satisfaction, which can lead to reduced employee turnover.

Knowing that they and their families are covered for medical and other contingencies can boost the morale of employees.

Registration and contribution to the ESI scheme ensure compliance with the Employees’ State Insurance Act, helping employers avoid legal issues and penalties.

The ESI scheme limits the financial liability of employers in cases of sickness, maternity, disability, or death of an employee due to employment injury.

Contributing to the welfare of employees through ESI enhances the employer’s image and improves employer-employee relations.

Employers are required to deposit the ESI contributions (both the employer’s and employee’s share) by the 15th of the month following the month for which the contribution is due. For example, the ESI contribution for the month of March should be deposited by the 15th of April.

The ESI returns need to be filed twice a year. These returns include employee details and the contributions made during the period.

Return Periods and Due Dates:

Yes, employees can withdraw their PF balance partially or fully under certain conditions like retirement, unemployment, or for specific expenses like home loans, medical emergencies, etc.

UAN stands for Universal Account Number, a unique number assigned to each PF member that helps in managing PF accounts and ensures portability across jobs.

Yes, for eligible employees and employers, PF contribution is mandatory under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952.

PF balance can be checked online through the EPFO portal, UMANG app, or by sending an SMS or making a missed call if your UAN is registered with EPFO.

Employees earning more than Rs. 15,000 per month at the time of joining are eligible to opt out of PF, but this decision must be made at the beginning of their employment.

ESI is a self-financing social security and health insurance scheme for Indian workers that provides medical, monetary and other benefits.

Employees earning up to Rs. 21,000 per month working in non-seasonal factories with 10 or more employees are covered under ESI.

Benefits include medical treatment for the employee and family, cash benefits during illness and maternity and compensation for employment injury.

The total contribution is 4% of the employee’s wages, of which the employee contributes 0.75%, and the employer contributes 3.25%.

ESI provides benefits in kind (like medical care) and in cash (like sickness benefit) but does not allow direct withdrawal of money.

We proudly announce our new website packed with updated data, resources, and valuable information