If you are one of the entrepreneur who are starting a new business and meet certain criteria, then right to choose Startup. Apki Return team will help with maximum tax exemptions to set up your Business.

A startup is essentially a business venture initiated by an individual or a small group of people who identify and seek to resolve specific problems within a business context. The inception of a startup often originates from the entrepreneurial spirit of its founders, who may have prior experience in an existing company or industry. These individuals notice inefficiencies, gaps, or challenges in the current market and decide to create a new company or entity to address these issues.

The formation of a startup is not a spontaneous or arbitrary decision; it is a deliberate response to perceived problems or opportunities in the market. Once the founders have a solid idea and a plan to bring it to fruition, the next step is to formalize the venture. Startup registration is a critical step in this process. This involves legally establishing the business, which can include tasks such as registering the company name, obtaining necessary licenses and permits, and fulfilling other regulatory requirements.

Get the business name availability status directly on WhatsApp

First, you need to legally incorporate your business as a Private Limited Company, a Limited Liability Partnership (LLP), or a Partnership firm. This involves registering your company with the Ministry of Corporate Affairs (MCA) in India and obtaining a Certificate of Incorporation.

The DSC is necessary for the electronic submission of applications and documents. It is used to verify the authenticity of the documents submitted electronically.

Each director of the company needs to obtain a DIN, which is a unique identification number.

The next step is to register your company as a startup under the Startup India scheme. This is done by filling out a form on the Startup India website, providing all necessary details, and uploading the required documents.

You need to upload several documents during the registration process, including the Articles of Association (AOA), Memorandum of Association (MOA), PAN Card of the company, proof of the registered office address, and KYC documents of the directors.

A letter of recommendation or a letter of funding is required. This can be obtained from an incubator recognized by the Government of India, an angel investor, a private equity fund, or a SEBI registered accelerator.

Startups in India are eligible for various tax benefits. To avail these, you need to apply for them separately during the registration process.

Startups need to self-certify their compliance with certain labor and environmental laws.

Upon submission of the registration form along with all necessary documents, you will receive a recognition number immediately. However, the certificate of recognition is issued after the documents are examined.

PAN Card of proposed Directors

Both PAN and Aadhaar Card of all Indian Shareholders and Directors.

Business Address Proof

Either of the latest Utility Bill (Electricity, Telephone, Gas, Water) or Property Tax Bill of the registered office address. Rent agreement and NOC from the owner in case of rented property.

Aadhaar Card/ Passport of proposed Directors

Either Voter ID, Passport, or Driving License of the Shareholders and Directors.

Mail ID and Mobile number

Mail id and Mobile number of proposed Director along with Draft Articles of Association and Draft Memorandum of Association.

Latest passport size photograph of proposed Directors

Latest passport size photographs of all the Shareholders and Directors.

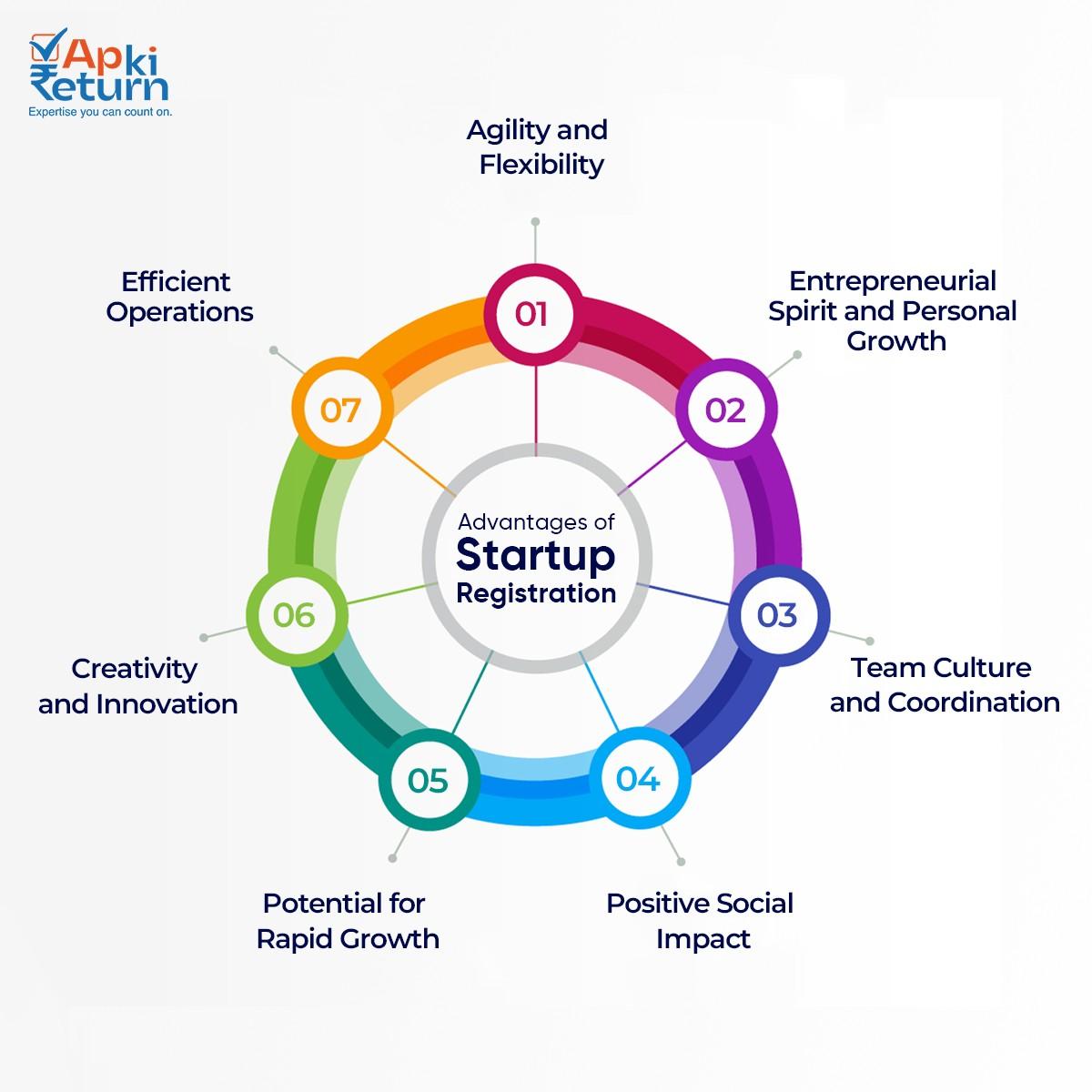

Startups are typically based on unique ideas or solutions, allowing for a high degree of creativity and innovation. This environment encourages exploring new concepts and technologies, often leading to ground breaking products or services.

Due to their smaller size and less structured nature, startups can quickly adapt to market changes and disruptive technologies. This agility extends to their operations, allowing for more personalized service and flexible solutions for customers.

Working in a startup often fosters a strong entrepreneurial spirit, contributing to a dynamic and motivated work environment. The challenges faced in this setting can also lead to significant personal and professional growth.

Startups tend to operate more efficiently with lower administrative overheads. This allows them to offer competitive pricing and focus on their core strengths.

The smaller size of startups typically leads to a close-knit team culture, where employees share passion and values, and work closely together, enhancing team coordination and productivity.

Many startups aim to make a positive impact on society, either through their business practices or the products and services they offer.

Startups have the potential for quick scalability, especially if they identify a unique niche or value proposition.

We believe in complete hand holding of our client, we will assign a personal manager to help you complete the entire process of company registration.

We will assist you in following areas:

There are few compliances which needs to be done as per the schedule of the MCA, major activities are listed below for your reference, as our time will also help you out not to miss any of the compliances.

This is a one-time activity, to be done once every year.

This is a one-time activity, to be done once every year. As per Income Tax Laws ITR-6 needs to be filed by the Companies along with Tax Audit report (if applicable) to be digitally signed.

As per Companies Act, within 30 days of incorporation, the company is required to appoint the C.A. for conducting the ROC audit.

This is a one-time activity, to be done once every year. At the end of the financial year, when income tax return has been filed and ROC Audit report has been prepared, the Annual Return under Form AOC-4 & Form MGT-7 are required to be uploaded on the MCA portal which are required to be digitally signed by Director’s and C.A. who has conducted the Audit.

A startup is a young company founded by one or more entrepreneurs to develop a unique product or service and bring it to market. By its nature, a startup tends to be a shoestring operation, with initial funding from the founders or their friends and families.

A startup is designed to grow rapidly and scale, often disrupting traditional markets or creating new ones. In contrast, a small business typically aims for steady, sustainable growth within an existing market.

Startups often face challenges such as securing funding, managing cash flow, perfecting a product, gaining market traction, and dealing with competition.

Startups can be funded in several ways, including bootstrapping, angel investors, venture capitalists, crowdfunding, and government grants.

A business plan outlines a startup’s vision, mission, market analysis, financial projections, and business model. It’s crucial for attracting investors, guiding the startup’s growth, and managing strategies.

Scaling a startup means setting the stage to enable and support growth in the company. This involves ensuring that your business model, infrastructure, and resources can handle increased demand.

Startups drive innovation, create jobs, and can significantly contribute to economic growth. They often introduce new technologies and business models, impacting various sectors.

Intellectual property is critical for startups, especially those based on innovative technology or creative products. It protects the startup’s inventions, brands, and original works from competitors.

An exit strategy is a plan for how the founders will leave the startup, typically through selling the company (acquisition) or going public (IPO), thereby converting the business into financial gain.

Mentorship is vital in providing guidance, advice, and networking opportunities for startups. Experienced mentors can help navigate early-stage challenges and accelerate growth.

We proudly announce our new website packed with updated data, resources, and valuable information