Looking to establish your own Private Limited Company….. You’re at the perfect Place. The Apki Return team is here to efficiently handle all the compliance aspects for your Private Limited Company, ensuring a smooth start for your entrepreneurial journey.

A private limited company is a form of business organization that combines the benefits of limited liability with a degree of flexibility and operational privacy. Characterized by the suffix “Private Limited” or “Pvt Ltd” after its name, this business structure restricts the ownership of shares to a selected group of individuals or entities, often limiting the number of shareholders.

One of the key advantages of a private limited company is the concept of limited liability, which means that the personal assets of shareholders are protected in the event of business debts or legal issues. This feature promotes entrepreneurship by mitigating the financial risks associated with business activities.

Private limited companies have a separate legal identity from their owners, enabling them to enter into contracts, own assets, and incur liabilities in their own right. This legal separation enhances the company’s stability and longevity.

While enjoying the benefits of limited liability, private limited companies have the flexibility to operate more privately compared to their public counterparts. They are not required to disclose financial information publicly, fostering a level of confidentiality that can be advantageous in certain business strategies.

Despite the restrictions on share transfers and public fund raising, private limited companies are a popular choice for small to medium-sized enterprises, offering a balance of legal protection, operational flexibility, and privacy for their shareholders.

Get the business name availability status directly on WhatsApp

Begin by obtaining Digital Signature Certificates for the proposed directors. This is a crucial step as it ensures the security and authenticity of documents submitted electronically.

Obtain a Director Identification Number for all directors. DIN is a unique identification number required for anyone looking to be appointed as a director of a company.

Gather and prepare all necessary documents as per the requirements, including but not limited to identity proof, address proof, and photographs of the directors.

Check the availability of the proposed company name. It should be unique and not similar to any existing registered entity. This can be done through the Ministry of Corporate Affairs (MCA) portal.

Once the name is approved, proceed to file an online application using the SPICE+ (Simplified Proforma for Incorporating Company Electronically) form. Submit all required documents, including the Memorandum of Association (MOA) and Articles of Association (AOA), online with the Registrar of Companies (ROC).

Upon successful completion of the application process and verification by the ROC, the company will be issued a Certificate of Incorporation. This certificate officially establishes the existence of the private limited company.

It’s important to note that the specific requirements and procedures may vary by jurisdiction.

PAN Card of proposed Directors

Both PAN and Aadhaar Card of all Indian Shareholders and Directors.

Business Address Proof

Either of the latest Utility Bill (Electricity, Telephone, Gas, Water) or Property Tax Bill of the registered office address. Rent agreement and NOC from the owner in case of rented property.

Aadhaar Card/ Passport of proposed Directors

Either Voter ID, Passport, or Driving License of the Shareholders and Directors.

Latest passport size photograph of proposed Directors

Latest passport size photographs of all the Shareholders and Directors.

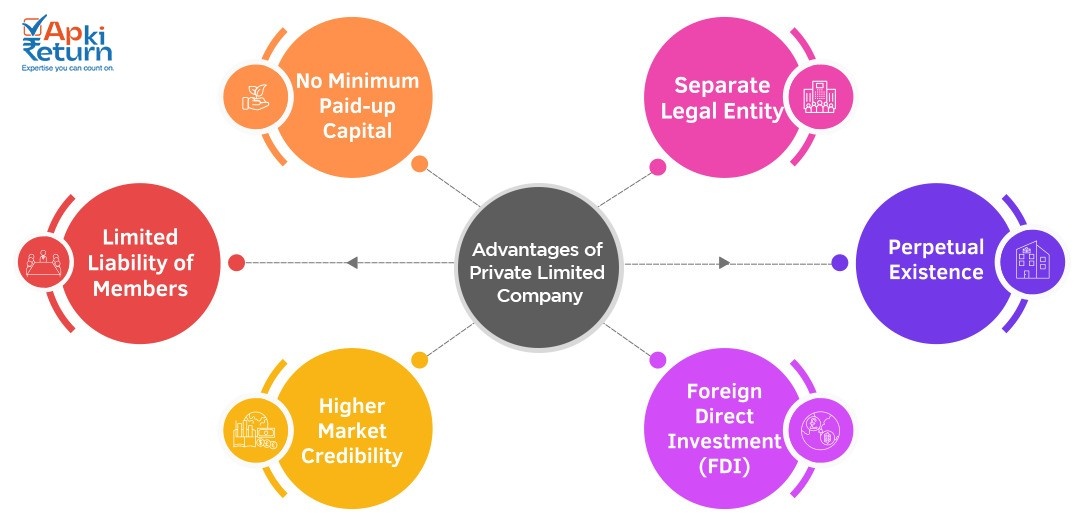

Members bear liability for the company’s debts only to the extent of their shareholding, providing personal financial protection.

Private limited companies can be registered with a nominal authorized share capital, eliminating the requirement for a minimum paid-up capital.

Private limited companies enjoy a distinct legal entity separate from their members, ensuring a clear division between management and ownership. Managers are held accountable for the company’s financial losses.

As a separate legal entity, the company continues to exist independently of changes in leadership or membership. The business operations persist regardless of the founders’ or directors’ status.

Private limited companies permit 100% Foreign Direct Investment (FDI), allowing foreign individuals or entities to invest directly in the company.

Companies incorporated in compliance with MCA norms gain heightened credibility in the market. Adherence to specific regulations and compliance requirements makes the company more trustworthy for suppliers, vendors, investors, and other businesses. Basic information about the company is easily accessible on the MCA website.

| Particulars | Private Limited Company | Public Limited Company | Limited Liability Partnership | One Person Company |

|---|---|---|---|---|

| Applicable Act | Companies Act 2013 | Companies Act 2013 | LLP Act 2008 | Companies Act 2013 |

| Number of Members | Minimum 2 | Minimum 7 | Unlimited Partners | Only 1 Required |

| Number of Directors | 2 to 15 | 3 to 15 | 2 Partners | Only 1 Required |

| Capital Requirement | Zero | Zero | Zero | Zero |

| Extent of Liability | Limited | Limited | Limited | Limited |

| Foreign Direct Investment | Eligible | Eligible | Eligible | Eligible |

| Statutory Audit | Required | Required | Required | Required |

| Compliance Frequency | Yearly | Yearly | Yearly | Yearly |

| Tax Rate | 22% | 22% | 30% | 22% |

We believe in complete hand holding of our client, we will assign a personal manager to help you complete the entire process of company registration.

We will assist you in following areas:

There are few compliances which needs to be done as per the schedule of the MCA, major activities are listed below for your reference, as our time will also help you out not to miss any of the compliances.

This is a one-time activity, to be done once every year.

Now-a-days, all the companies getting registered in India, need to obtain Business Commencement Certificate within 180 days of its incorporation. It’s a One Time Activity. For this compliance, the directors are required to deposit the Paid-up capital in the account of the company, and share the Bank statement to the MCA for verification purposes.

This is a one-time activity, to be done once every year. As per Income Tax Laws ITR-6 needs to be filed by the Companies alongwith Tax Audit report (if applicable) to be digitally signed.

As per Companies Act, within 30 days of incorporation, the company is required to appoint the C.A. for conducting the ROC audit.

This is a one-time activity, to be done once every year. At the end of the financial year, when income tax return has been filed and ROC Audit report has been prepared, the Annual Return under Form AOC-4 & Form MGT-7 are required to be uploaded on the MCA portal which are required to be digitally signed by Director’s and C.A. who has conducted the Audit.

A Private Limited Company is a type of business entity that is privately held and limited by shares. It offers limited liability to its shareholders and is a separate legal entity from its owners.

A minimum of two directors is required for the registration of a Private Limited Company in many jurisdictions.

A DSC is an electronic form of a physical signature used for online transactions. It is required for filing documents electronically with regulatory authorities, ensuring the security and authenticity of the information.

The MOA specifies the company’s objectives and the AOA outlines the rules governing its internal management. Both documents are filed during the incorporation process and define the company’s structure and operations.

The timeline varies by jurisdiction, but it typically takes a few weeks to complete the entire process, from obtaining DSC to receiving the Certificate of Incorporation.

Yes, many jurisdictions allow foreign nationals to be directors in a Private Limited Company. However, there are often additional requirements, such as obtaining a Director Identification Number (DIN).

In many jurisdictions, there is no specific minimum capital requirement for a Private Limited Company. The capital can be decided based on the business needs.

Private Limited Companies typically need to file annual financial statements with the regulatory authorities. The frequency and requirements may vary by jurisdiction.

Yes, the name of a Private Limited Company can usually be changed after incorporation by following the prescribed procedures and obtaining approval from the regulatory authorities.

Yes, Private Limited Companies are generally required to comply with ongoing regulatory obligations, including filing annual returns, conducting annual general meetings, and maintaining proper accounting records.

We proudly announce our new website packed with updated data, resources, and valuable information