Filing your Income Tax Return (ITR) can seem challenging, but with the right guidance, it can be a smooth process. This blog will guide you through the process for ITR Return filing in 2024, breaking it down into simple steps.

By the end of this guide, you’ll be capable of handling your ITR filing with confidence.

What is ITR Filing?

Income Tax Return (ITR) is a document which you file with the Income Tax Department of India. It contains the details regarding the income you earned and taxes paid during the previous financial year e.g. for F.Y. 2023-24.

Who Needs to File ITR?

Not everyone needs to file an ITR. Here are some situations where filing an ITR is mandatory:

- Your gross total income exceeds the basic exemption limit (which varies depending on your age and tax filing status).

- You have income from sources other than your salary, such as business income, capital gains, rental income or interest on SB a/c and FDRs

- You want to carry forward losses incurred in previous years.

- You wish to claim a tax refund regarding TDS deducted under any of the income head specified above.

Documents required for ITR Filing

Before you start the process for ITR filing, it’s crucial to gather all the necessary documents. Here’s a checklist to help you:

- PAN Card: This is your unique identification number for income tax purposes.

- Aadhaar Card: While not mandatory for everyone, having an Aadhaar card simplifies the verification process significantly.

- Form 16: If you’re salaried, you’ll receive this form from your employer. It details your salary income, deductions made, and taxes deducted at source (TDS).

- Investment Proofs: If you’ve made any tax-saving investments, keep the proofs handy (e.g., PPF statements, life insurance policy receipts, etc.).

- Bank Statements: These may be required if you have income from other sources like interest on fixed deposits or rental income.

- Capital Gains Statements: If you’ve sold any capital assets like stocks or mutual funds, keep the capital gains statements.

Process for ITR Filing

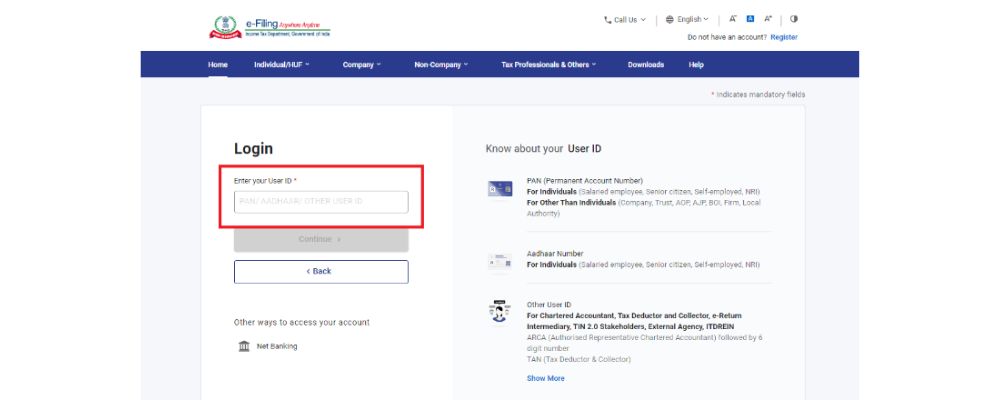

Step 1: Register or Login to the Income Tax e-Filing Portal

The first step in the process for ITR filing involves registering or logging in to the Income Tax e-Filing portal

- New Users: If you’re filing your ITR for the first time, you’ll need to register on the portal. This involves providing your PAN details, and personal information, and setting up a password.

- Existing Users: If you’ve filed your ITR previously, you can directly login using your PAN and password.

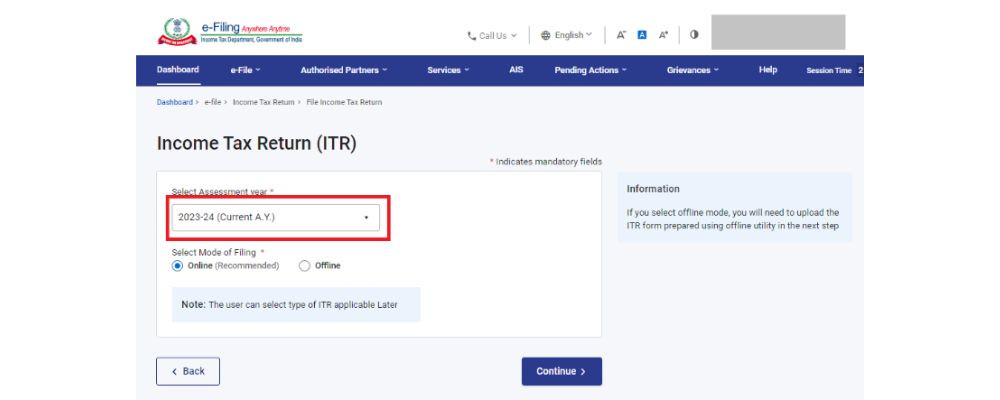

Step 2: Select the Assessment Year (AY)

The Assessment Year (AY) refers to the financial year for which you’re filing your ITR. For instance, if you’re filing your ITR for the year ended on 31st March 2024, the AY will be 2024-2025 (since ITR filing typically happens for the previous financial year).

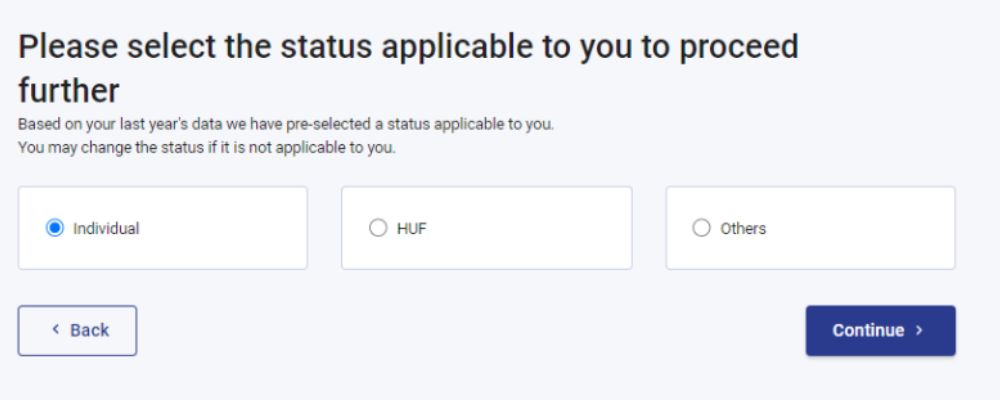

Step 3: Choose the Right ITR Form

There are different ITR forms applicable to various taxpayer categories. The most common ones are:

- ITR-1 (Sahaj): For individuals with income from salary, pension, one house property, and other income up to Rs. 5000.

- ITR-2 (Sahaj): For individuals with income from salary, house property (multiple), capital gains, and business/profession income.

- ITR-4 (Sugam): For individuals and Hindu Undivided Families (HUFs) with business/profession income under specific sections and total income up to Rs. 50 lakh.

The Income Tax Department portal provides detailed guidance on choosing the right ITR form based on your income sources.

Step 4: Fill Out the ITR Form

Once you’ve selected the appropriate form, you’ll be presented with an online form to fill in your income details. The portal offers pre-filled information based on the Form 16 you upload (if applicable).

Carefully review and edit the pre-filled information, and then proceed to enter details for other income sources, deductions claimed, taxes paid, etc. The portal provides instructions and tooltips to guide you through each section.

Step 5: Validate and Submit Your ITR

After filling out the form, thoroughly review all the information you’ve entered to ensure accuracy. Once you’re confident, validate your ITR using one of the following methods:

Aadhaar OTP: This is the simplest method if you have an Aadhaar card linked to your PAN.

Conclusion

By following these steps and gathering the necessary documents beforehand, you can navigate the process of ITR filing with confidence. Remember, the deadline to file your ITR for the financial year 2023-2024 (AY 2024-2025) is typically July 31st, 2024. Don’t delay – take charge of your tax filing today!

Our team of experts at Apki Return can guide you through the process of ITR filing and ensure accuracy.

Don’t wait until the last minute! Start your ITR filing in Jaipur today with Apki Return. Visit our website www.apkireturn.com or call us at +91 766 515 6000 to get started!